Who We are

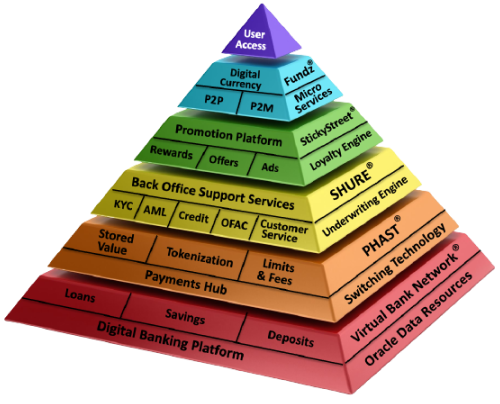

Technology & Functionalities by Neofie

Neofie Pyramid

- Automated KYC Onboarding

- Admin Control Panel with Analytics Dashboard

- Branded iOS/Android/Web Apps for All Browsers

- Real-time Processing System, Apple Pay & Google Pay, 250+ Payment Methods

- Security with Oracle & AWS Technology

- Loyalty Platform, 5% Cashback, Investment & Insurtech & Merchant Accounts

- Dedicated Technical, Compliance, & Customer Support

- IBAN / ACH Issuing for individuals, BillPay, & Bank Licensing in all 50 States

- 3rd Party Integrations & API Portal

- White-label Card Program (Virtual, Plastic, & Metal Cards) + P2P Transfers, QR & Link Mobile Payments

Branded iOS/Android/Web Apps

Neofie offer high-end mobile and Web applications development services that meet the client’s multiplatform requirements, ensuring the Omni channel experience across various devices and platforms.

Automated KYC Onboarding

Automated KYC provides clients with a frictionless experience by eliminating the frequent back-and-forth interactions between customers and banks when new information is required. With automated processes, customers are given an easy and fast accreditation and identification experience that results in quicker account opening.

Admin Control Panel with Analytics Dashboard

Neofie platform includes an easy to use admin panel for configuring the various items of a banking solution, and a user-friendly front end for employees who serve customers.

Neofie uses Oracle Analytics to enable clients monitor their business performance in real time.

Real-time Processing System

Neofie utilizes Real-time processing APIs, Apple Pay & Google Pay, 250+ payment methods, to increase the authorization rates, maximize transactions value, and broaden global payments coverage. Neofie platform has more than 150 currencies covered, on-demand reporting and risk & fraud management options.

Security with Oracle and AWS Technology

Hybrid cloud native architecture from AWS and Oracle infrastructure and platform as a service provisioning, allowing highly secure and scalable support for mobile based financial services business models and deliveries.

Loyalty Platform

Neofie offers a Loyalty Platform called StickyStreet that is a recognized industry leader used by companies like T.J. Maxx to support their loyalty and offer consumer programs. This platform can accommodate all sorts of rewards based on any type of event defined by the configuration. Events can include transactions (number and/or amounts), balances held, total monthly spend, months or years as a member, use of specific services, and others.

Neofie BaaS platform can accommodate other existing Loyalty programs as an integrated system using Neofie or the Loyalty vendors APIs.

Dedicated Technical, Compliance, & Customer Support

Neofie is dedicated to providing high standards of personalized technical and business support. Neofie’s team of compliance technology specialists will provide support every step of the way. Advice, planning, configuration, and ongoing support are part of the services Neofie delivers.

3rd Party Integration & API Portal

Neofie’s BaaS platform is built using the Open API structure to easily integrate with other ecosystems and third-party applications. The Neofie underline cloud real-time and API based architecture based on AWS and Oracle provides the functionality and processing capacity and security to operate in this type of hybrid financial services eco-systems.

Bank Licensing in all 50 States

IBAN / ACH Issuing for individuals & Bank Licensing in all 50 States. Every account is FDIC Insured up to $250,000.

White Label Card Program

Neofie offers White label (virtual, metal and plastic cards) card programs including P2P transfers, QR code and linked mobile payments. Get the most value out of every transaction with Neofie’s connected payments systems.

Get In Touch

By signing up, you agree to the Terms of Service.