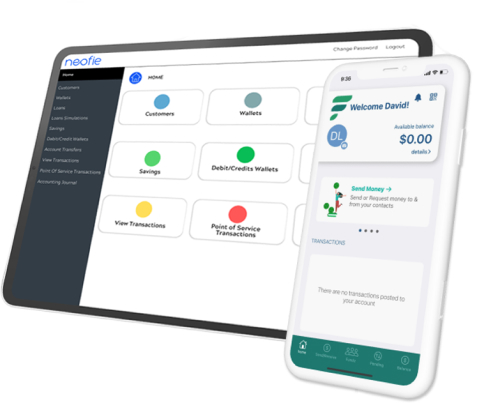

How Neofie Works

Neofie builds, scales, and evolves financial systems of wide reach. Neofie works with clients and partners to deploy Banking-as-a-Service (BaaS) platforms for neobanks, embedded finance, financial institutions and MVNOs from design to go-live. The agile methodology provides an efficient approach for the whole lifecycle from requirement analysis to product suite versioning.

Who We are

How Neofie Works?

Banking as a Service

Neofie’s turnkey Banking-as-a-Service approach is to minimize the client-partner work by providing all the platform elements in one box: digital core technology, web and mobile app, payment switch, processing, bank sponsorship and KYC/AML. This enables the client-partner to focus on customer acquisition and marketing, while Neofie manages the technical and compliance details.

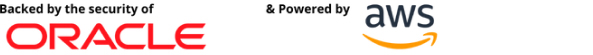

White Label Digital

Banking Solutions

White Label Digital Bank Solutions

The Neofie White Label program allows clients to quickly and effectively create competitive digital banking offerings to strengthen, enhance and develop the relationship with their customers.

Embedded Finance

In Banking Solutions

Embedded Finance In Banking Solutions

Demand for mobile financial services is soaring and shifting the banking approach.

Neofie provides the required integrated finance and FinTech solutions, with security and compliance and a simplified back-end process for clients to focus on consumers acquisition and customer relationship.

Digital Core Banking

With Neofie

Digital Core Banking With Neofie

Neofie Digital Core Banking (NDCB) is the accelerated and cost efficient path to digitalizing the bank’s infrastructure, ledger and end-user experience. NDCB is a comprehensive cloud-native financial services platform to directly acquire, track, and serve bank customers through mobile devices. Neofie platform can be hosted on the cloud to facilitate and enhance customer management, product offerings, settlements, accounting, reporting, and business governance while providing real-time processing for the financial services requirements.

Technology &

Functionality

Neofie cloud-native platform is equipped to support true contemporary end-user centric digital banking. Neofie BaaS provides customers with real-time access to banking services such as deposits, account inquiries, and fund transfers, and supports multi-lingual and multi-currencies operations.

Thanks to the extensive adoption of Application Programming Interfaces (APIs) to access third parties’ new services the Neofie BaaS platform provides all the elements needed for open banking, it can facilitate digital transformation to increase transparency and enhance the customer experience. The BaaS model allows financial services providers and non-financial businesses to connect with banks’ systems directly via APIs to offer their customers personalized banking products and services under their own brands.

Get Started With Neofie

You can choose one or multiple services at a time.

- Contact us.

- Define the desired products by choosing from Neofie’s offerings menu.

- Provide branding elements.

- Choose customizations & integrate with existing apps, website, or product offerings.

- Launch & Soar.

Lets Get Started

By signing up, you agree to the Terms of Service.