Our

Products

Neofie helps you launch your branded Neobank by providing the technology, support, and bank sponsorship you need in a secure and compliant manner – All under one platform.

Our

Products

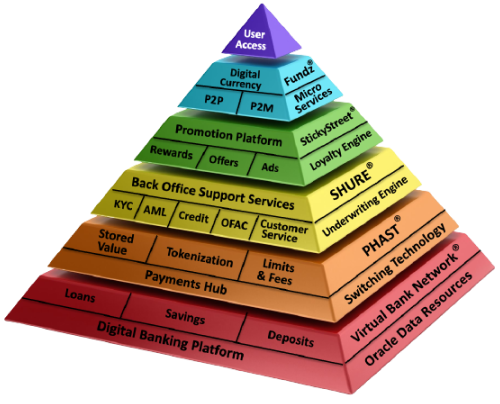

Neofie helps you launch your branded Neobank by providing the technology, support, and bank sponsorship you need in a secure and compliant manner – All under one platform.Neofie helps you launch your branded Neobank by providing the technology, support, and bank sponsorship you need in a secure and compliant manner – All under one platform.What makes us different? We’re glad you asked. We are a full service, turnkey white-label Neobank with a full coreless, real-time cloud banking platform backed by the security of Oracle and powered by AWS

Banking as a Service

Bank Sponsorship

Get your blood tests delivered at

home collect a sample from the

your blood tests.

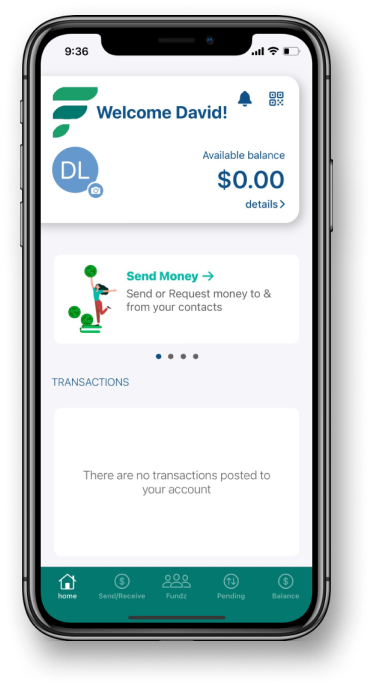

Consumer Facing App

Get your blood tests delivered at

home collect a sample from the

your blood tests.

Core Banking Systems

Get your blood tests delivered at

home collect a sample from the

your blood tests.

Fraud and Complaince Service

Get your blood tests delivered at

home collect a sample from the

your blood tests.

White Label For

Your Business

White Label For Your Business

Neofie white label program helps to build efficiently and rapidly, cost-effective true digital banking products to serve, expand and grow your relationship with your customers.

Embedded Finance

In Banking Solutions

Embedded Finance In Banking Soultion

Neofie lending product offerings are engineered to deliver a comprehensive FinTech suite, to engage directly with customers for rapid and real-time lending transactions and resolutions. Neofie for Digital Lending can provide access to data analytics, algorithms and cloud- computing for the financial operators to provide new lending offerings to would-be borrowers.

Digital Core

Banking

Digital Core Banking

Digital banking is no longer a theory. NEOFIE has significantly invested to support the growth of Challenger and Neo banks looking for a complete digital banking platform. As result NEOFIE SaaS is a comprehensive digital banking suite that incorporates enterprise-grade technology that efficiently provides to Challenger and Neobanks the ability to offer services such as checking and savings account, payment of bills or money transfers, loans to individuals and businesses, other such services directly on their mobile phone or via any other digital platform.

Technology & Functionality

Technology :

- Mobile Open Mesh Banking Architecture - MOMBA®

- Mobile First

- MicroServices based (Open Mesh)

- Digital Banking

- Integrates Mobile Payment and Digital Banking platforms

- Patented Digital Currency platform (stored value) - Fundz ®

- Payments Hub and Switching Technology - PHAST ®

- Software Hosted Underwriting Rules Engine - SHURE ®

- SaaS based Rewards, Offers and Ads platform - StickyStreet ®

- Digital Banking Platform - deposits, savings, loans

- Oracle data infrastructure, Analytics and AI functionality

Technology & Functionality

- Branded iOS/Android/Web Apps for All Browsers

- Automated KYC Onboarding

- Admin Control Panel with Analytics Dashboard

- Real-time Processing System, Apple Pay & Google Pay, 250+ Payment Methods

- Security with Oracle & AWS Technology

- Loyalty Platform, 5% Cashback, Investment & Wealth Management, Insurtech & Merchant Accounts

- Dedicated Technical, Compliance, & Customer Support

- IBAN / ACH Issuing for individuals, BillPay, & Bank Licensing in all 50 States

- White-label Card Program (Virtual, Plastic, & Metal Cards) + P2P Transfers, QR & Link Mobile Payments

- International Money Remittances, Multi-currency Wallets, & Cryptocurrency

- 3rd Party Integrations & API Portal

- Teams based in USA and Europe

Meet Our Team

We have been working with clients around the world

We have been working with clients around the world

David Hanna Chairman

Chairman of the Board, billionaire and co-founder of Atlanticus Holdings Corporation, serving 17 M customers delivering > $10 B in lending products. David is a Trustee and co-founder of Holy Spirit Preparatory School in Atlanta, Georgia. Director of Piedmont Healthcare in Atlanta. Board of Trustees of the Lumen Institute and the Knights of Malta. David Hanna is co-founder of NEOFIE.

Johnny Wright Board Member

Johnny Wright has come to be known as one of the foremost music managers of all time. Through hard work, creativity and a strong sense of commitment he has developed successful ventures from music management to film and television production. He is currently CEO of Wright Entertainment Group (WEG) and No. 83 on The 2015 Billboard Power 100 which roster includes Justin Timberlake, Lance Bass, Akon and Incubus.

Nabil Kabbani CEO

Kabbani is a global CEO in Fintech. He ran several businesses over twelve years at Western Union, helping it grow to a multi-billion dollar public company working from various locations in the U.S., Beirut, Dubai, Paris and Brussels. He has led VC and PE funded businesses at various stages, is versed in M&A and fundraising. He has grown several businesses multi-folds and is a regular industry speaker.

Jeff Howard Board Member

CEO of Atlanticus, has been President and a director since April 2001 and has served as Executive Managing Director and as Director of Corporate Development since 2001. He runs company’s operations and has insightful institutional knowledge. In addition to his 17 years of experience in the consumer finance industry, Mr. Howard has significant experience in corporate development.

Giovanni DalMaso COO

Giovanni supervises the company operations and the portfolio of NEOFIE’s offerings by leveraging the experience of executive roles held in FinTech, software, and technology companies. He is skilled in alignment of business & technology and deployment of global operating models. He has worked in Europe, UK, Switzerland, and USA and his professional career has been consistently in the hi-tech.

Ricardo Giovannone CTO

Ricardo supervises the NEOFIE SaaS and Product Suite, the software labs, and the R&D of new products. Being a technology expert, he manages the integration and delivery of NEOFIE products in the target markets. As VP of Integration at a First Boston-Credit Suisse/IBM, Ricardo has extensive experience in managing large scale and/or mission critical programs and platforms in multiple Global Financial System deployments.

Our Offices